The Activision Blizzard Q1 2020 financial results conference call took place today May 5, 2020 at 4:30pm ET / 1:30 PT.

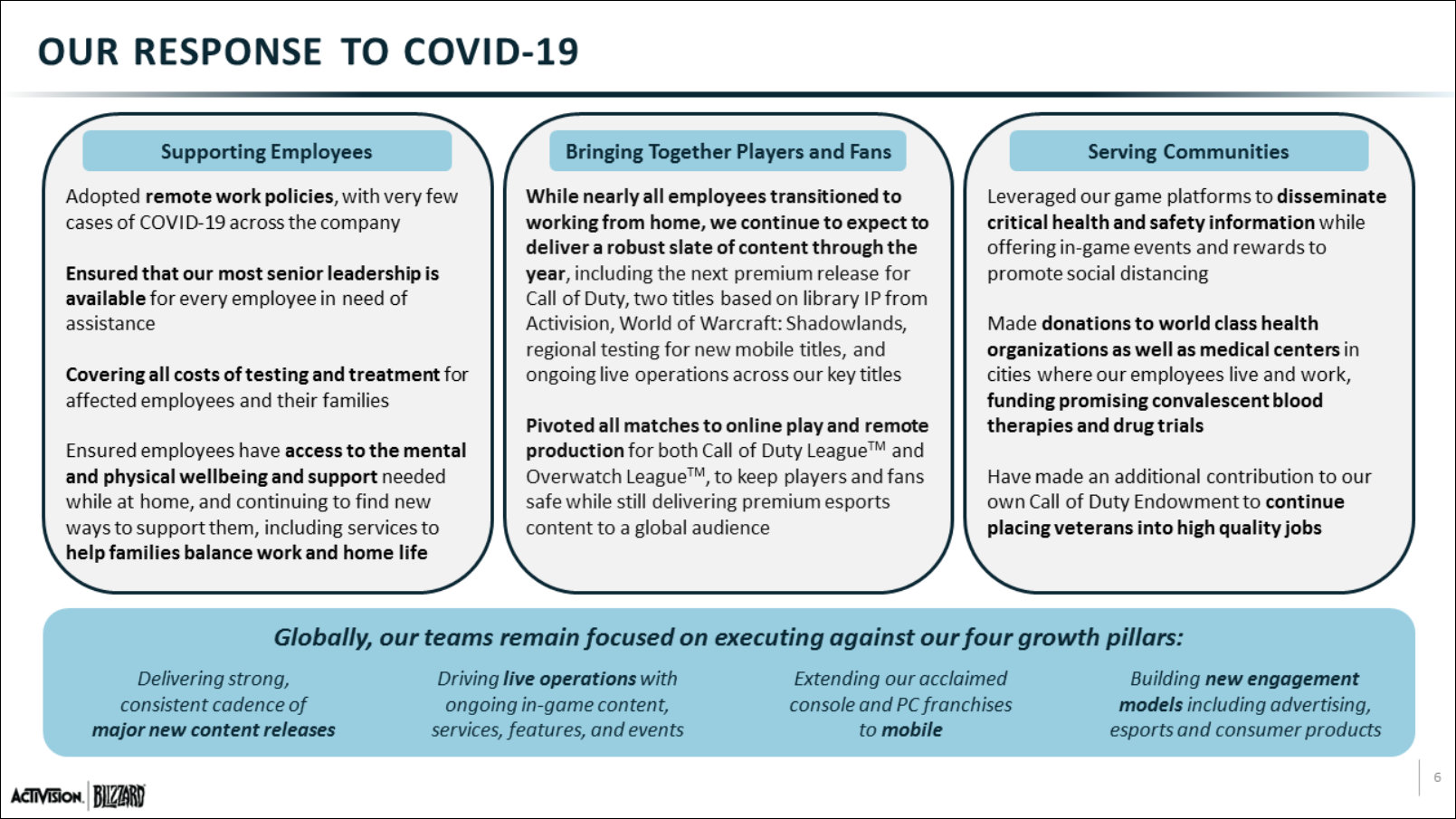

Activision Blizzard saw continued momentum for World of Warcraft and better-than-expected results for other key franchises, as populations sheltering at home turned to their content for entertainment and social connection.

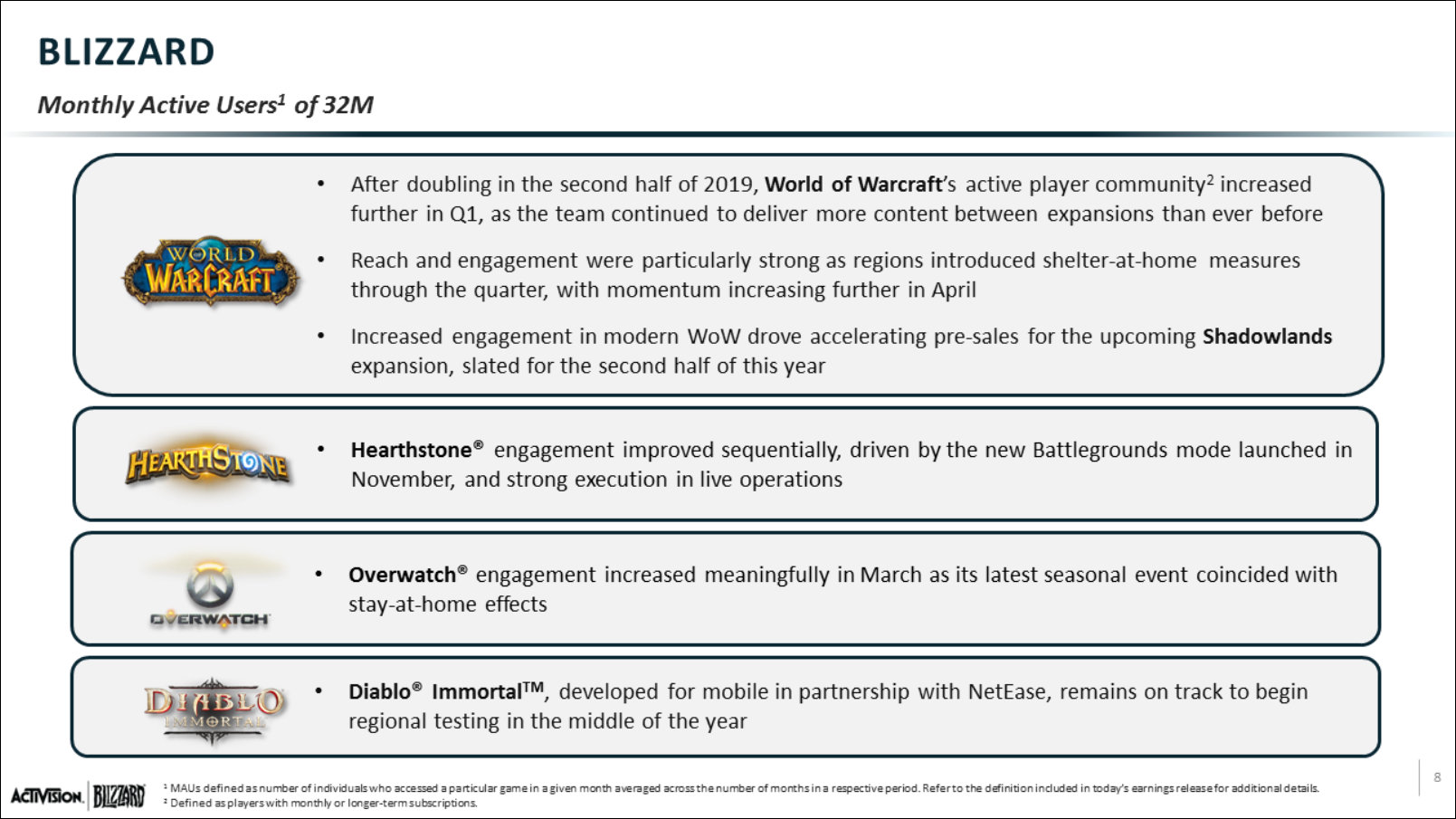

During the conference, regional testing for new mobile titles was mentioned. We know that Diablo Immortal beta will start some time mid-2020 (probably around June), but the plural mention here means there is another mobile game going into beta. The second one might be in relation to Activision or King, as Blizzard has not yet announced what the Unannounced Mobile Game is — but rumors last year pointed toward a Warcraft Pokemon Go-meets-Warcraft Pets type of game.

E3 and GamesCom have been cancelled due to the pandemic, so it might be safe to say the second mobile beta mentioned here is not Blizzard-related.

Shadowlands is slated for the second half of this year.

Diablo Immortal remains on track to begin regional testing in the middle of the year.

Once again, they do not expect revenue from Diablo Immortal this year — which could be interpreted in two ways: either Diablo Immortal will be free to download (with monetization options coming later), or the Diablo Immortal launch is 2021. The latter is reason to get worried. So we will have to wait for news.

There was a portion of the conference call where it was strongly hinted that we might see Overwatch, and/or Warcraft and/or StarCraft mobile games. Not exactly in those words, but you can extrapolate, by association, from this quote: “… extending our acclaimed console and PC franchises to mobile.“

CONFERENCE SUMMARY

- Blizzard had 32 million MAUsD in the first quarter.

- After doubling in the second half of 2019, World of Warcraft’s active player community increased further in the first quarter, driven by both new and returning players, as the team continued to deliver more content between expansions than ever before.

- Each of Blizzard’s key franchises experienced a month-on-month increase in MAUs in March as a result of shelter-at-home tailwinds.

- Hearthstone® engagement improved sequentially, driven by the new Battlegrounds game mode launched in November, and strong execution in live operations.

- Overwatch® engagement increased meaningfully in March and the Overwatch LeagueTM successfully moved to online play and remote production during the quarter.

A curated transcript focusing on the Blizzard portion of the conference call will be available some time late evening.

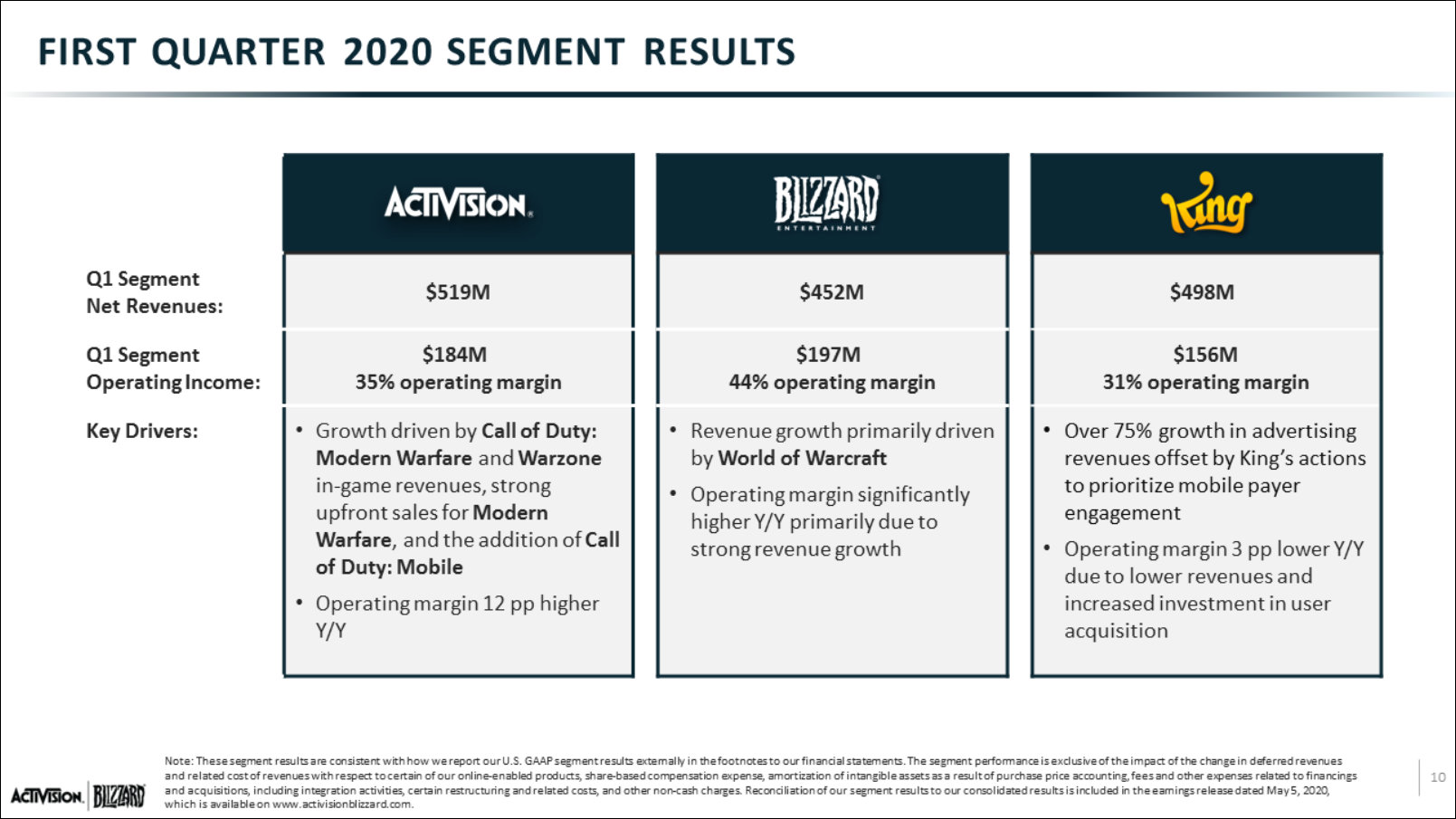

Concentration of Sales Among the Most Popular Franchises

The concentration of retail revenues among key titles has continued as a trend in the overall interactive entertainment industry. According to The NPD Group, the top 10 titles accounted for 33% of the retail sales in the U.S. interactive entertainment industry in 2019. Similarly, a significant portion of our revenues historically has been derived from video games based on a few popular franchises, and these video games have also been responsible for a disproportionately high percentage of our profits. For example, in 2019, the Call of Duty, Candy Crush, and World of Warcraft franchises, collectively, accounted for 67% of our consolidated net revenues—and a significantly higher percentage of our operating income.

In addition to investing in, and developing sequels and content for, our top franchises, with the aim of releasing content more frequently, we are continually exploring additional ways to expand those franchises, such as our recent release of Activision’s Call of Duty: Warzone, an all-new free-to-play experience from the world of Call of Duty: Modern Warfare for the console and PC platforms. We also have been focusing on expanding our franchises to the mobile platform, as demonstrated by the recently released Call of Duty: Mobile, as well as our plans for Diablo ImmortalTM, which is currently in development.

Overall, we do expect that a limited number of popular franchises will continue to produce a disproportionately high percentage of our, and the industry’s, revenues and profits in the near future. Accordingly, our ability to maintain our top franchises and our ability to successfully compete against our competitors’ top franchises can significantly impact our performance.

Recurring Revenue Business Models and Seasonality

Increased consumer online connectivity has allowed us to offer players new investment opportunities and to shift our business further towards a more consistently recurring and year-round model. Offering downloadable content and microtransactions, in addition to full games, allows our players to access and invest in new content throughout the year. This incremental content not only provides additional high-margin revenues, it can also increase player engagement. Also, mobile games, and free-to-play games more broadly, are generally less seasonal than premium games developed primarily for the console or PC platforms.

While our business is shifting toward a year-round engagement model, the interactive entertainment industry remains somewhat seasonal. We have historically experienced our highest sales volume, particularly for Activision, in the calendar year-end holiday buying season.

Change in Deferred Revenues Recognized

The decrease in net deferred revenues recognized for the three months ended March 31, 2020, as compared to the three months ended March 31, 2019, was driven by (1) a decrease of $185 million in net deferred revenues recognized from Activision, primarily due to lower net revenues recognized from Call of Duty: Modern Warfare, which was released in October 2019, as compared to Call of Duty: Black Ops 4, which was released in October 2018 and (2) a decrease of $120 million in net deferred revenues recognized from Blizzard, primarily due to lower net deferred revenues recognized from World of Warcraft, driven by revenues recognized in the prior period from World of Warcraft: Battle for Azeroth®, which was released in August 2018, with no comparable recognition of deferred revenues in the current period given no comparable release in 2019.

In-game Net Revenues

In-game net revenues for the three months ended March 31, 2020, were slightly lower than for the three months ended March 31, 2019, primarily due to a decrease in in-game net revenues of $89 million driven by:

- lower in-game revenues from King, primarily due to lower revenues from player purchases, driven by the Candy Crush franchise;

- lower in-game revenues recognized from World of Warcraft;

- and lower in-game revenues recognized from Overwatch.

The increase in Blizzard’s net revenues for the three months ended March 31, 2020, as compared to the three months ended March 31, 2019, was primarily due to:

- higher revenues from World of Warcraft, primarily driven by higher subscription revenues due to the release of World of Warcraft Classic in August 2019, and revenues associated with in-game content delivered to customers upon pre-purchase of World of Warcraft: Shadowlands, with no comparable revenues in the prior period; and

- revenues from Warcraft III: Reforged, which was released in January 2020.

| ACTIVISION BLIZZARD Q1 2020 TRANSCRIPT | |||||

| Summary | Transcript (Part 1) | Transcript (Part 2) | Transcript (Part 3) | Q&A | |

Hope you enjoyed this article. Please, support Blizzplanet via PayPal or Patreon, and follow us on Twitter, Facebook, YouTube, and Twitch for daily Blizzard games news updates. |

|