The Activision Blizzard Q2 2021 investors call kicked off with Bob Kotick addressing a zero tolerance stance on discrimination of any kind. Shortly after, we got confirmation of Diablo Immortal release delayed to the first half of 2022. Jen Oneal, new co-leader of Blizzard Entertainment, revealed they are expanding and doubling recruitment for the Overwatch 2 and Diablo IV teams.

Follow @blizzplanetcom for updates.

Among the Highlights:

- Diablo Immortal release postponed to the first half of 2022.

- Diablo Immortal closed beta planned for 2021.

- Overwatch 2 reached internal milestone.

- Two unannounced Warcraft mobile games.

- Several major new titles across PC, console, and mobile from Blizzard in 2022.

SLIDESHOWS

Activision Blizzard Q2 2021 Investors Call Transcript

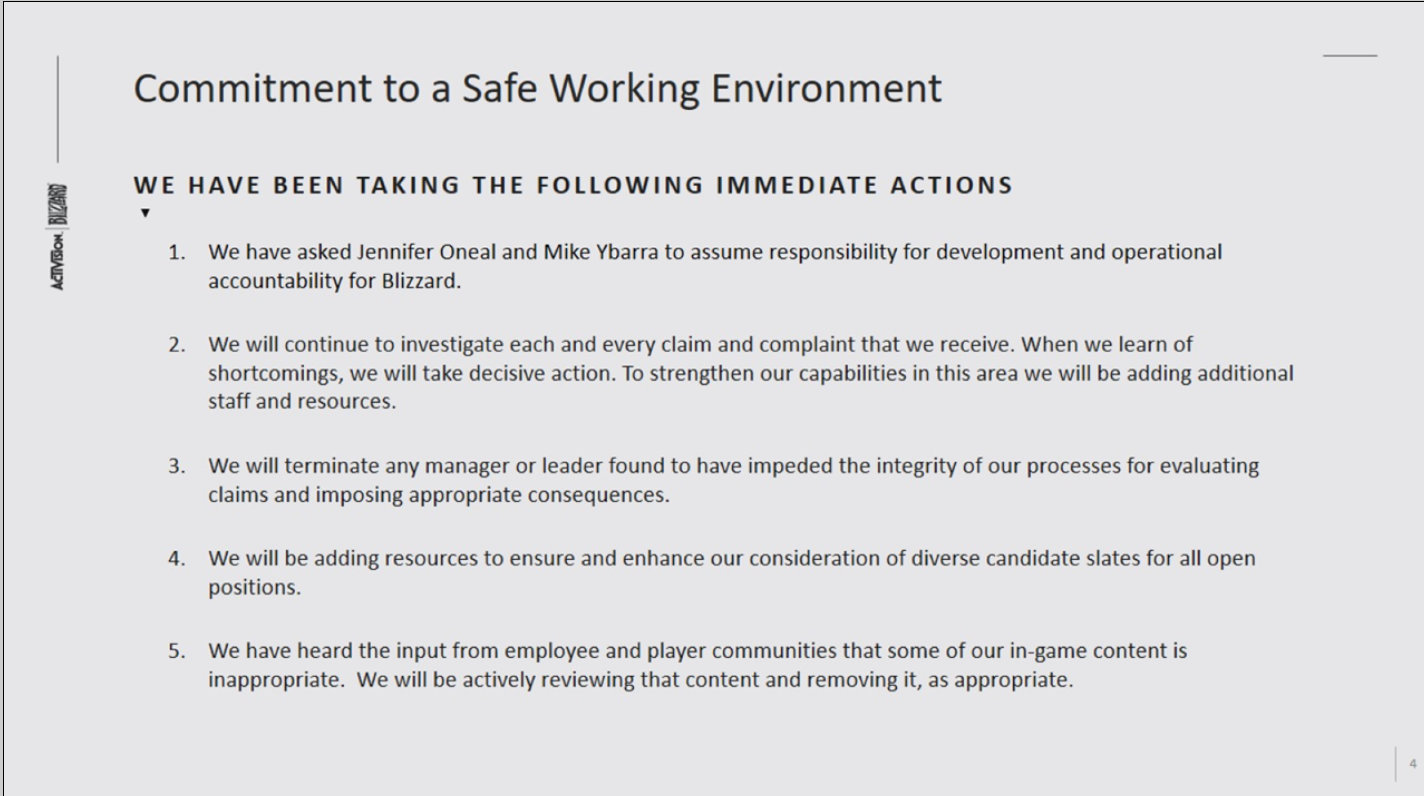

Bobby Kotick: I want to start by making clear to everyone that there is no place at our company where discrimination, harassment, or unequal treatment of any kind will be tolerated. Nowhere.

We so appreciate the current and former employees who have come forward in past and recent days with courage; and I want to reiterate the commitments we have made to you.

Our work environment, everywhere we operate, will not permit discrimination, harassment or unequal treatment. We will be the company that sets the example for this in our industry. While we’ve taken many steps towards this objective already, today, we are taking even more.

Jennifer Oneal and Mike Ybarra have been named the new co-leads of Blizzard. Jen has been with the company for 18 years. She is the former head of our studio, Vicarious Visions, and most recently had production and development oversight for our Diablo and Overwatch franchises.

Mike has been in our industry for over 20 years, including in leadership roles within the Microsoft Xbox division, and at Blizzard as general manager of Battle.net.

I’m also pleased to have Allen Adham here today. As most of you know. Allen is one of the founders of Blizzard. After a 12-year hiatus, Allen returned to Blizzard to lead our new product and new IP incubation efforts.

Each of these individuals brings vast industry experience and tremendous integrity to their roles. They are the very best examples of leadership with character and accountability.

I’m confident this team will ensure that Blizzard provides a welcoming, comfortable, and safe workplace that is essential to foster creativity and inspiration.

In addition, we’ll continue to investigate each and every claim and compliant that we receive. When we learn of shortcomings, we will take decisive action; and to strengthen our capabilities in this area, we’ll be adding additional staff and resources. People will be held accountable for their actions.

That commitment means that we will not just terminate employees where appropriate, but will also terminate any manager or leader found to have impeded the integrity of our processes for evaluating claims, and imposing appropriate consequences.

Because our work cannot be successful without diverse voices, views, and talents, we made a commitment to consider diverse slates of candidates for all open positions; and we’ll continue to add resources to ensure this occurs throughout the company.

Over the past several years, we’ve made significant changes to address company culture, reflect more diversity within our leadership teams, and create environments conducive to reporting any type of misconduct.

We’ve amplified internal programs that encourage employees to report violation. We’ve reinforced channels for employees to voice concerns in confidential and safe ways without any fear of retaliation.

We’re directing additional resources to our compliance and employee relations teams dedicated to investigating complaints.

We pride ourselves on paying our employees competitively and fairly for equal or substantially similar work. We regularly review our compensation to ensure that we remain equitable in our approach.

We take a variety of proactive steps to ensure that pay is driven by nondiscriminatory factors such as performance, role, and expertise; and we conduct extensive anti-discrimination trainings, including for all employees involved in the compensation process.

Our workplace initiatives are crucial to our continued success, and our leadership in this effort is my priority. Our workplace safety also remains our priority; and as we consider our return to work initiatives, we remain focused on providing the very best healthcare for our employees and their families.

You have my unwavering commitment that we will continue to focus on serving our players and delivering the sustainable growth that you’ve come to expect; and we will take all necessary actions to foster a culture that is supportive and welcoming for all of our employees; and we expect to be the very best example for other companies to emulate.

Daniel will now review the highlights of our operations for the past quarter with you.

Daniel Alegre: I’d like to underscore the point that Bobby made regarding the company’s commitment to ensuring the very best work environment. The leadership team and I will do our utmost to make sure that we’re always improving and building the kind of inclusive workplace that is essential to enable creativity, and professional growth for all employees.

There will be no tolerance at our company for harassment or unequal treatment of any kind. Our continued stock performance is because of the effort of our incredibly talented people; and we will make certain the workplace facilitates the best possible performance through constant improvement to our culture and unwavering conviction to our values.

Now turning to the second quarter, we exceeded our prior outlook benefiting from strong execution by our creative and commercial team in delivering compelling experiences and in-game content to our deeply engaged community.

Over the last two years, we have increased investment in our biggest opportunity, creating new ways for our communities to engage, and investing in our franchises across platforms.

This strategy has significantly expanded the financial scale of our three largest franchises: Call of Duty, World of Warcraft and Candy Crush; and this work continued to deliver strong results in the second quarter, even as countries continue to reopen from lockdowns due to the pandemic.

Looking forward, we continue to transform our franchise portfolio through faster delivery of compelling premium content, more robust in-game operations, expanding to mobile, and accelerating new engagement models, including free-to-play and advertising.

Now, I’ll discuss our Q2 franchise, and operational highlights across our business units.

We couldn’t be more excited about the leadership changes. Jen and Mike are outstanding leaders, and we look forward to the impact they will have on the culture, accountability and fostering the very best work environment.

The launch of Burning Crusade Classic in June marked the start or what is intended to be a very significant 18 month period for content releases. MAUs was 26 million.

In the Warcraft franchise, World of Warcraft net bookings again grew double-digits year-over-year in the second quarter, driven by the well-received launch of Burning Crusade Classic in June. Subscriber numbers and hours-played were up following the release again showing the importance of Classic and enabling more ways for players to engage in WoW. The strength in Classic added to ongoing deep engagement in the modern game following the Q4 Shadowlands launch, and the launch of the first major content update in June; and as a result, WoW remains on track for much stronger engagement this year than is typical outside of a modern expansion year.

Elsewhere in the Warcraft Universe, Hearthstone’s latest expansion “Forged in the Barrens” delivered expansion-over-expansion net bookings growth for a second consecutive release; and with the latest expansion “United in Stormwind” launched today, and “Mercenaries” — a new mode in the popular roleplaying genre planned for the coming month, we expect Hearthstone’s financial performance to strengthen in the second-half of the year.

Blizzard continues to make progress in its work on ambitious new Warcraft mobile experiences that can attract entirely new players to the franchise, as well as offering new ways for existing fans to engage. Warcraft mobile experiences are in various stages of internal testing, with the team looking forward to sharing more about these titles soon.

Now turning to Diablo, we have added hundreds of developers to the franchise over the last three years, and we continue to grow our teams as we prepare to launch three unique and complementary experiences across platforms.

Diablo II: Resurrected will launch on PC and console on September 23. Anticipation for this remaster of the quintessential action roleplaying game is high; and we can’t wait for the community to experience the quality of the title.

On mobile, Diablo Immortal continues to progress well through testing, receiving excellent feedback for its gameplay. We see substantial potential for this release both in its own right, as a long-running authentic Diablo experience, and to broaden the franchise’s reach ahead of Diablo IV.

Recent testing reveals some exciting additional opportunities the team is going to pursue to make the title even more engaging for a wider audience. While that means the game is now planned for release in the first-half of 2022, we believe these efforts will set the title up for even greater contribution next year and beyond.

And most importantly, Blizzard continues to make strong progress on Diablo IV. The game is shaping up incredibly well, and the team is allocating substantial resources to creating exciting content to drive engagement over multiple years.

The extended Overwatch team is similarly making strong progress on Overwatch 2 with development passing an important internal milestone in recent weeks. After great response to the recent community update, the team is looking forward to revealing more of the game in the coming months as they approach the later stages of production.

In summary, Q2 was another strong quarter. We’re taking actions to address stakeholder concerns and the adverse consequences to our business. If we experienced prolonged periods of adverse publicity, significantly reduced productivity or other negative consequences related to this matter, our business likely would be adversely impacted. We’re carefully monitoring all aspects of our business for any such impacts.

From a pipeline perspective, we have a strong line-up plan for the second-half of the year, and as we look to 2022, our current plans contemplate compelling new experiences across Call of Duty, WoW, and Candy, alongside several major new titles across PC, console, and mobile from Blizzard — with the aim to deliver significant expansion in the reach and engagement of our portfolio.

Above all, as we go forward, I want to reemphasize that the safety and well-being of our employees is of utmost priority. Our teams are the source of all creativity, and magic in our games.

Armin Zerza: I want to reiterate that our priority is ensuring a workplace that provides opportunity for all in the most welcoming and inclusive way possible.

Today, I’ll review our second quarter results, as well as our outlook for the third quarter, and full year 2021.

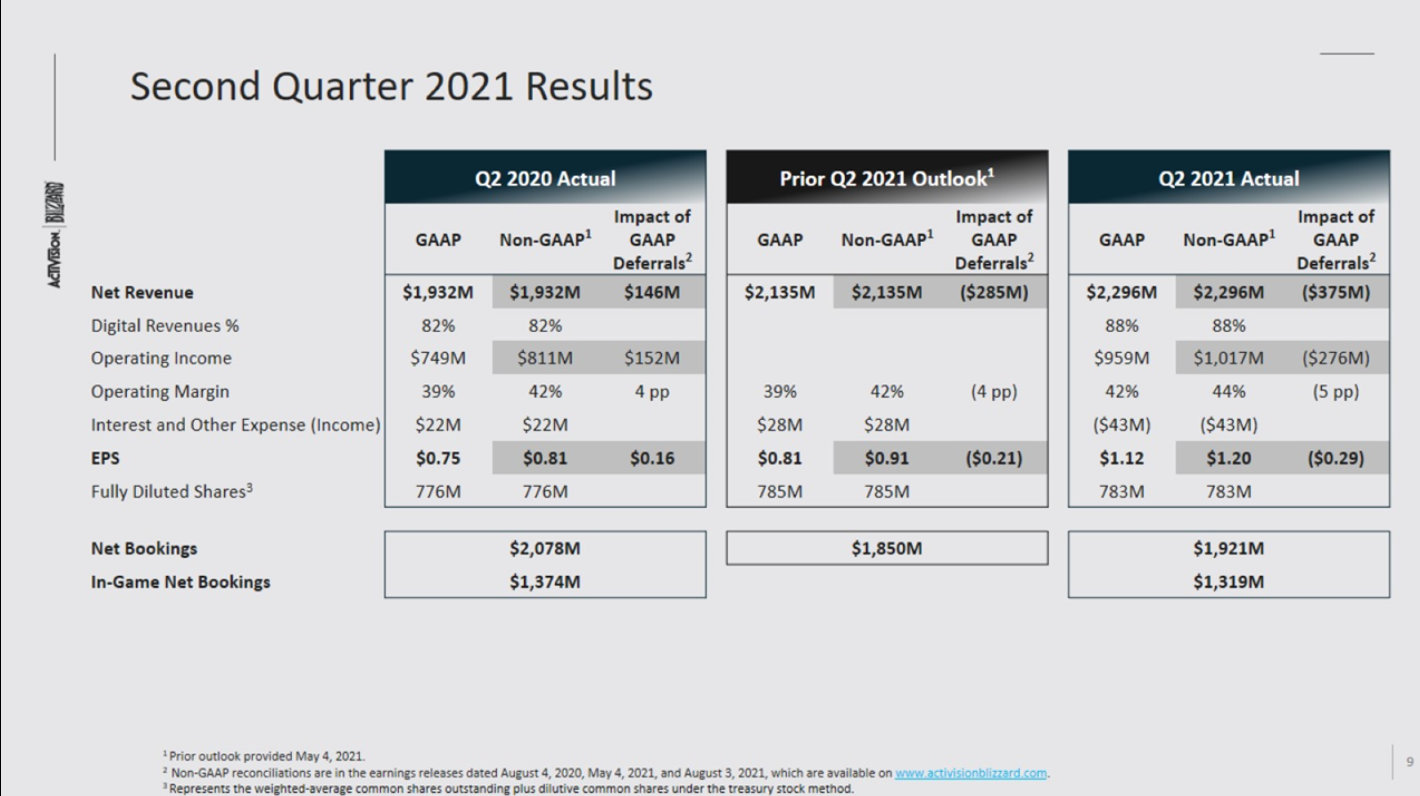

Our second quarter results were ahead of our prior outlook driven by both operational outperformance and some non-operating items.

For the first-half, we delivered double-digit year-over-year growth in net bookings and solid growth in operating income this year. We achieved new records for each, even as we continue to increase investment in the business and our development teams to support our strong pipeline. As regions reopen, our business continues to operate at significantly greater scale than that seen prior to our successful growth initiatives across our largest franchises.

Now, let me turn to our consolidated financial results. Unless otherwise indicated, I’ll be referencing non-GAAP figures. Please, refer to our earnings release for full GAAP to non-GAAP reconciliation.

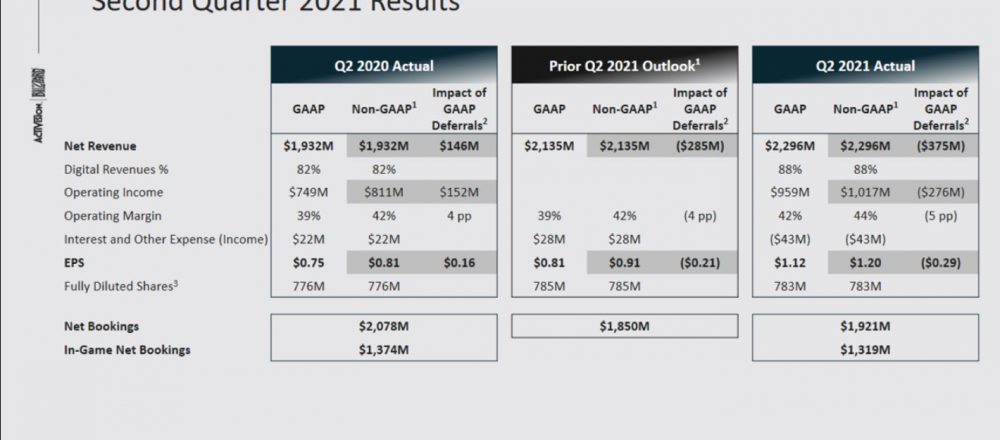

For the quarter, we generated Q2 GAAP revenues of $2.30 billion, $161 million above our May guidance. This includes the net recognition of deferrals of $375 million, net booking of $1.92 billion were $71 million above our May outlook; and we generated Q2 GAAP EPS of $1.12 and Q2 non-GAAP EPS of $1.20, which was $0.29 above our guidance.

These figures include the net recognition of deferrals of $0.29. Q2 EPS included a $0.07 benefit from a gain on an investment, most of which was unrealized. We also experienced a lower anticipated tax rate in the quarter due to the timing of overseas tax reform, so that our full year tax rate assumption is unchanged.

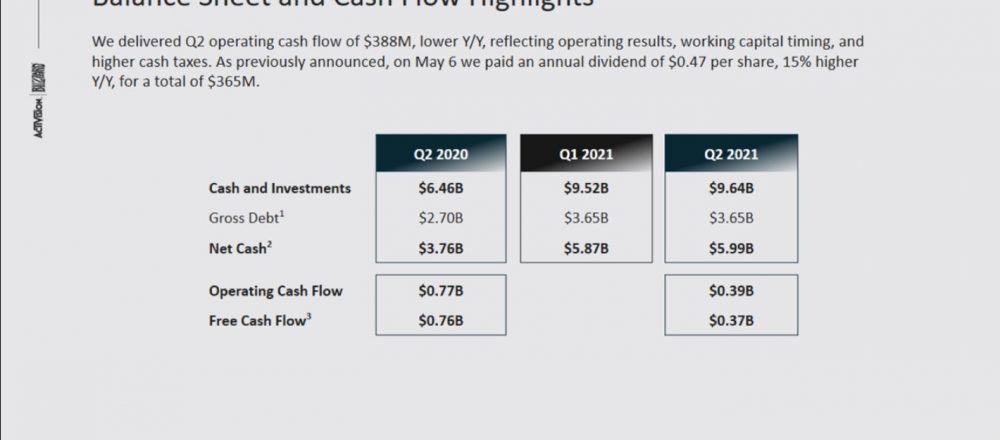

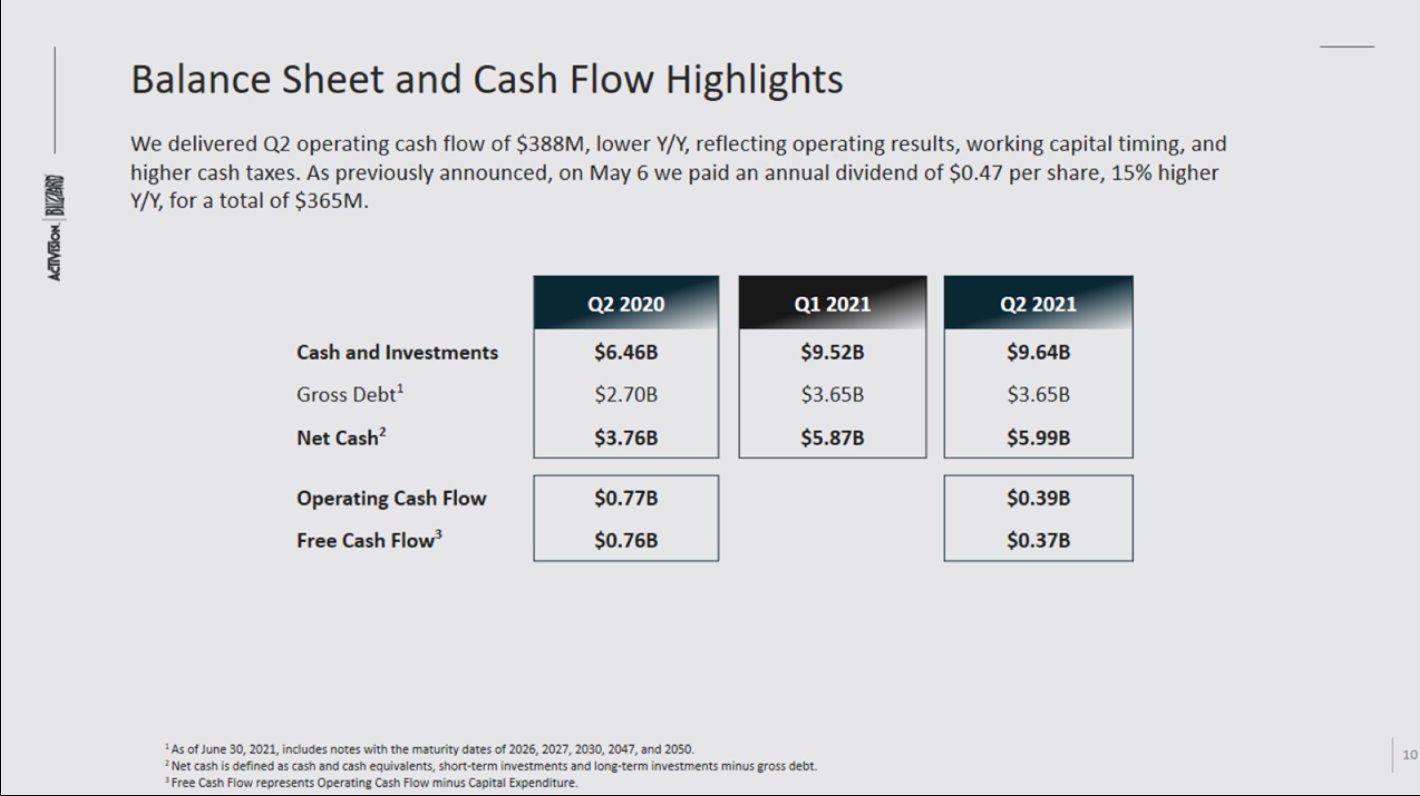

Now, turning to cash flow and the balance sheet, Q2 operating cash flow was $388 million, lower year-over-year effecting operating results, working capital timing, and the timing of cash taxes.

During the quarter, we paid an annual dividend of $0.47 per year, 15% higher year-over-year or a total of $365 million. Our cash and investments, at the end of June, were approximately $9.6 billion, and we ended the quarter with a net cash position of approximately $6 billion.

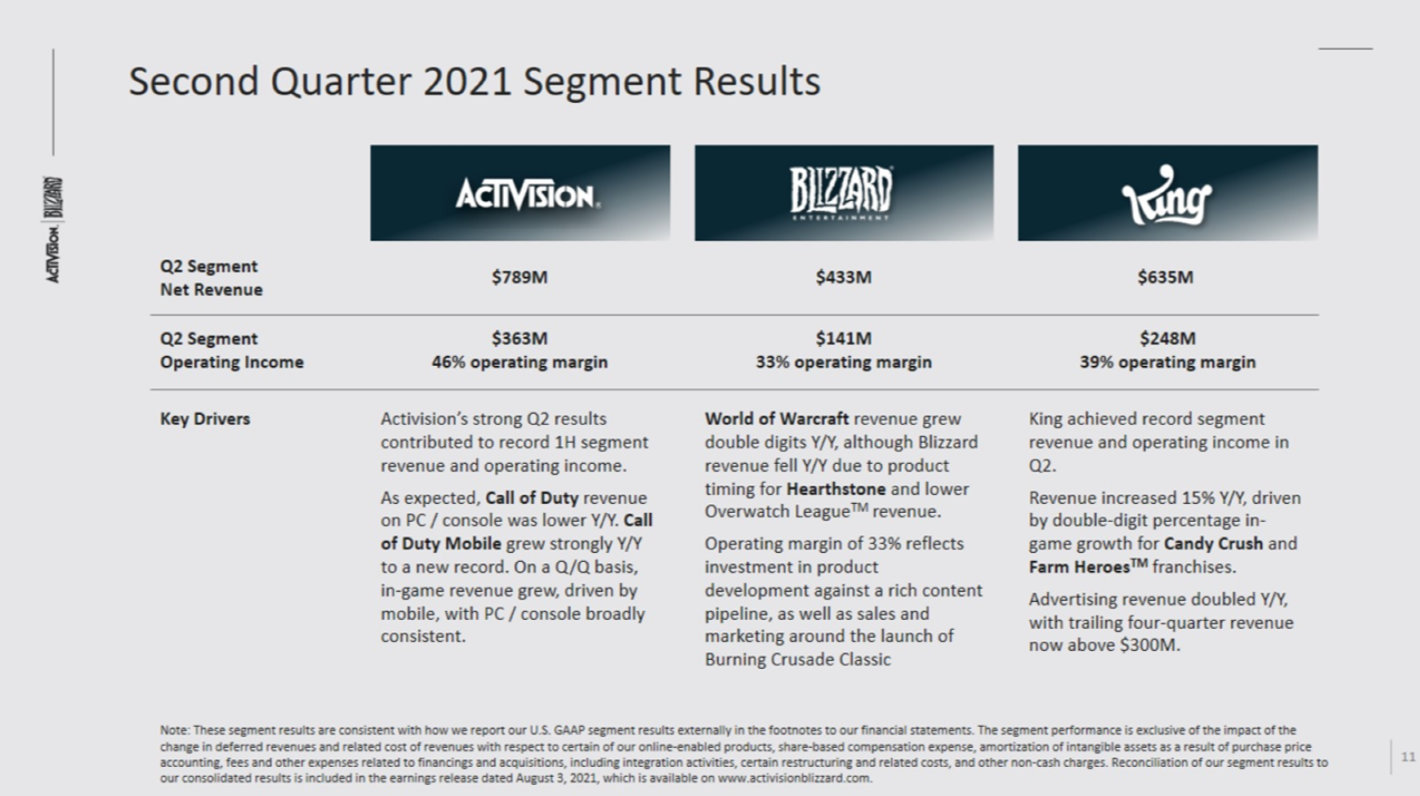

Now, let me turn to our segments results. Activision delivered another strong quarter contributing to record first-half segment revenue and operating income. Q2 revenue was $789 million.

As expected, Call of Duty revenue in PC and console was lower year-over-year against last year’s Q2 that benefited from the March 2020 launches of Warzone and Modern Warfare 2 remaster, as well as the introduction of the shelter-at-home mandate. However, Call of Duty: Mobile was strongly year-over-year. Q2 segment operating income was $363 million with an operating margin of 46%.

Blizzard revenue was $433 million with double-digit year-over-year growth in World of Warcraft — offset by product timing for Hearthstone, and lower Overwatch League revenue as explained in prior quarters. Operating income was $141 million with an operating margin of 33%, reflecting investments into product development against a rich content pipeline, as well as sales and marketing around the launch of Burning Crusade at quarter end.

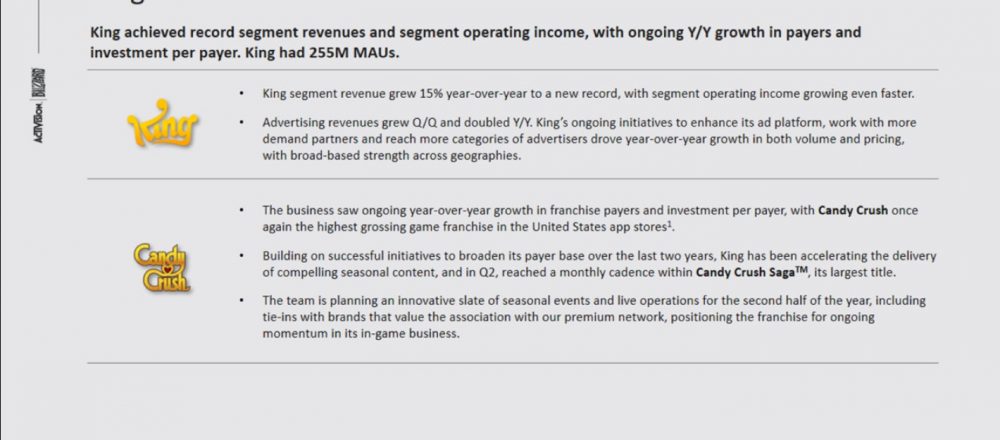

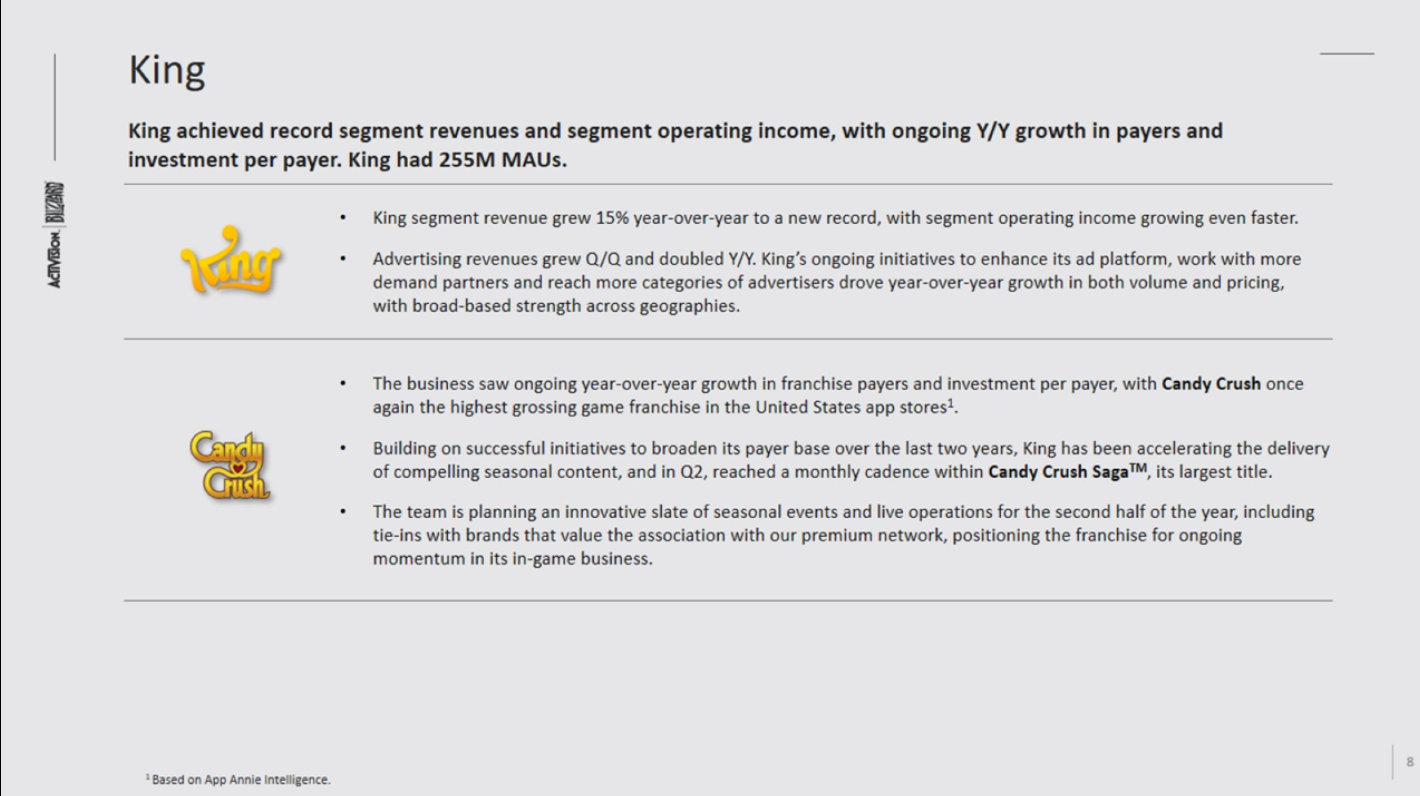

King revenue grew 15% year-over-year to $635 million. This is another new record driven by double-digits in-game revenue growth for Candy Crush and Farm Heroes. Advertising revenue doubled year-over-year, and trailing Q4 advertising revenue is now above $300 million for the first time. King operating margin was also strong at 39%, delivering record operating income at $248 million.

Across our segment’s strong execution in live operations and in-game content drove in-game net bookings to a combined $1.32 billion, broadly consistent with the level of the prior Q4; and almost 70% of total net bookings this quarter, the in-game business represents a recurring base of profitability for the company with a significant opportunity for further growth in both existing and new franchise experiences.

Finally, the second quarter saw a strong double digit year-over-year growth in mobile net bookings, which exceeded a $3 billion annualized run rate for the first time this quarter. The mobile platform delivered more than 40% of total net bookings and is a key strategic priority for us as we extend each of our key franchises to mobile in the coming year.

Now, let me turn to our outlook for the third quarter and full year. With regard to our slate, our expanded teams are focused on delivering epic in-game and upfront content.

In the third quarter, Activision (sp) enough content for Call of Duty Black Ops, Cold War and Warzone launches later this month and the team has continued to release significant new features, events and seasons for Call of Duty: Mobile.

Today, they just released Hearthstone’s latest expansion, United in Stormwind, Diablo II: Resurrected will launch on September 23rd, and King will support Candy Crush and other games across its portfolio with numerous seasonal events, features and innovative live operation.

In the Q4, in addition to ongoing life of in-game content across the portfolio, we’re looking forward to Activision launching new Call of Duty premium content alongside major new in-game experiences for Warcraft.

These are the most important releases of the year for us, and we can’t wait to show the community what our teams have been working on.

In the second-half, we will also continue to refine and test mobile content in our pipeline, including for both Warcraft and Diablo. Consistent with our prior outlook, we don’t include material revenue from the mobile cash flows in our guidance for the current year.

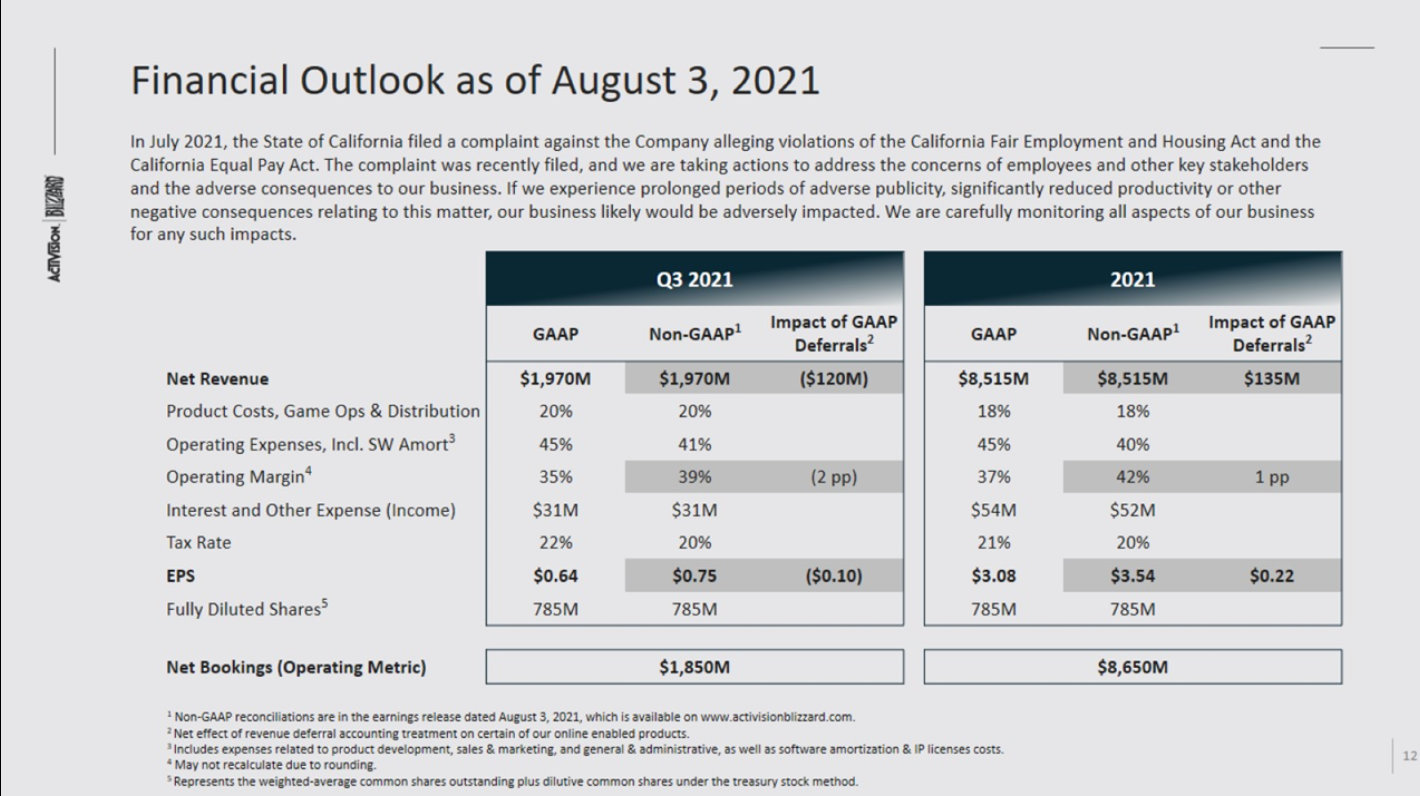

Now, for the specifics of outlook, let me provide some context. We are taking substantial actions to address the concerns of employees and other key stakeholders. Well, there are risks that our business could be adversely impacted as Daniel discussed. Currently, our business performance is strong. In the third quarter, we expect ongoing robust performance of Call of Duty, Candy and World of Warcraft to be complemented by the launch of Diablo II: Resurrected.

While we are taking a prudent approach to our outlook, we do expect year-over-year net bookings growth in the third quarter.

We will increase investments in the quarter in our product suite, compliance, employee relations and sales and marketing to help unlock the full potential of our franchises heading into 2022.

As we move into the fourth quarter, where we continue to invest in the business, we expect lower costs and growth in earnings year-over-year. Finally, as mentioned, we experienced an investment gain in the second quarter, which we are popping through in our outlook on acceleration at the end of July. Bringing this altogether, we are once again waking our outlook from net bookings, revenue and EPS for the year.

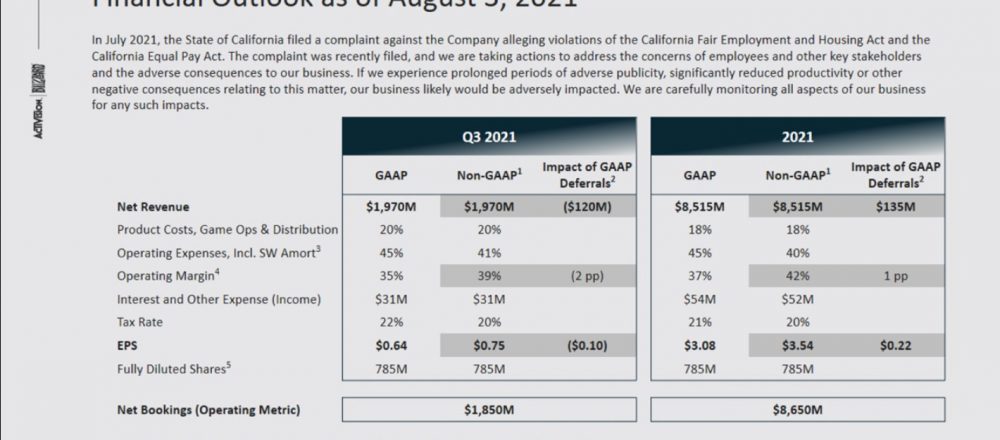

Now let me get into some specifics. For Q3 on a GAAP basis, we expect revenues of $1.97 billion, including the net recognition of the growth of $120 million. We expect net bookings of $1.85 billion. We expect a GAAP operating margin of 35%, a tax rate of 22%, GAAP and non-GAAP share count of 785 million, and EPS of 60%. For Q3 on a non-GAAP basis, we expect the tax rate of 20% and non-GAAP EPS of $0.75, including the net recognition of this growth of $0.10.

Now turning to the fiscal year on a GAAP basis for 2021, we expect revenues of $8.52 billion, including net deferrals of $135 million. We now expect net booking of $8.65 billion. We expect the GAAP operating margin of 37%, a GAAP tax rate of 21%, GAAP and non-GAAP share count of 785 million and GAAP EPS $3.08.

For 2021 on a non-GAAP basis, we expect a tax rate of 20% and non-GAAP EPS of $3.54, including net deferrals of $0.22.

In closing, our business continues to perform well in the second quarter, delivering strong results. We’ll continue investing in our creative teams and positioning our franchises for even greater reach and engagement in the future with our current plan continuing to support growth in our financial performance in 2022.

Look, as Bobby and Daniel made it clear, we understand that our people are our greatest asset. These are the people responsible for our continued strong performance. We couldn’t be more committed to ensuring and improve this work environment for all our employees, as well as for long-term sustainable growth. We will be working with our team to improve our company together to become the most inspiring and inclusive entertainment company possible.

Matthew Cost (Morgan Stanley): So, we’ve seen a lot of headlines about the lawsuit and employees’ concern. Can you talk more about what you’ve been doing and will do to address those issues? And then just secondly, can you expand on any expected impact to productivity as you work through the situation, and do you expect any impact on the pipeline?

Daniel Alegre: As you heard from Bobby, our employees are truly our greatest asset; and we remain absolutely focused as a leadership team on providing a diverse and a safe environment for our teams, and have taken a number of actions thus far. For instance, we have engaged an outside law firm to conduct a review of our policies and procedures with respect to our workplace and where employees can connect if they have experienced any issues whatsoever. We will also be adding staff to our compliance and employee relations teams, and investigate employee’s concerns.

This is to ensure that we are always considering also diverse candidates for all open positions. As a Hispanic leader myself, I know how important having a diverse workforce can be for all aspects of our business, and this is critical. We will be evaluating and training also our people managers to make sure they are complying with their processes for handling employee concerns, as well as taking the right action; and we are proactively engaging with our employees to hear and respond to their feedback.

For several years now, we have been focused on ensuring more diversity throughout the company, especially in our leadership roles, and have dramatically increased the number of women and minorities in both the C-suite and in our business unit; and our compensation practice is that women and men are paid equitably for equal work.

Now, as you heard, we have appointed Jen Oneal and Mike Ybarra as the new co-leads of Blizzard; and I am so glad that an original Blizzard Founder, Allen Adham, who returned to the company a few years ago, continues to lead our game incubation projects. We have a great leadership bench at Blizzard, and are excited about the new direction that the company will take. Also, we are committed to an equitable and safe work environment, and that’s what’s important. As we evolve our company, you should expect further announcements from us going forward.

Now, to answer your question on productivity and pipeline, as you heard today, the pipeline is progressing well. In particular, some of the content in the pipeline has been in development for many years, and it is approach the final stages of production. We’re monitoring the impact of recent events, obviously, as we discussed today. But based on what we see currently, we have a strong lineup planned for the second-half of the year; and as we look into 2022, we’re currently planning for several new titles across PC, console, and mobile from Blizzard, alongside more great experiences from Call of Duty, Candy, and Warcraft.

Mike Hickey (The Benchmark Company): Curious what you’re seeing on the global reopening or recovery, what sort of player engagement trends that you’re seeing, and how you’re thinking about or how you’ve shaped your guidance around key performance regions that are reopening?

Armin Zerza: Generally speaking, what we see are different trends across our franchises and games, and these trends can vary across platform, gameplay types, and numerous other factors. More specifically, when we looked at some of our largest franchises, we actually saw minimal variation in engagement and player investment as countries reopened; and even where we did see some variation, they were small relative to the structure of growth we have seen on the business in the last year or two.

Look, what’s really key is that when we look at the data, we see that product and other initiatives are the bigger determinants of reach and engagement.

So, we do believe that much of the expansion we have seen in our largest franchises is due to strong product initiatives, more frequent live operation, and new engagement models. All of which we have started to successfully implement. Examples of that include the introduction of free-to-play experiences on mobile such as Call of Duty, the launch of Classic on World of Warcraft, and more frequent compelling content on Candy Crush; and as a result, we are operating at much greater scale, and continue to have momentum, as evidenced by our Q2 result, as well as trends into July.

Now, as it relates to guidance, we are always thoughtful and careful in our approach. We assume lockdown guidelines and continue to moderate in the third quarter; and of course, they are monitoring any impact of recent trends, as discussed. But as you’ve heard, we still expect year-over-year growth in net booking as these initiatives continue to deliver results, and we start to generate the return from our many years of work to reinvigorate Diablo.

Finally, and looking forward, we see a long-term trend of more people gaming than ever before across genre, platforms, business models, and geographies; and as you know, we already operate successfully today across many of these growth vectors. So, we are very well positioned to continue to grow in the macro environment. Next, we believe growth is largely in our own hands, and our talented employees and teams.

Andrew Uerkwitz (Jefferies): This question, I guess, is really focused on what’s happening at Blizzard. It’s great to hear the color around the policies and procedures in creating safe workplaces and whatnot. However, I’m sure morale is low; and so, I’m just curious how Mike and Jen plan to kind of rekindle the pride that Blizzard has been known for, and just rebuild that morale, but also at the same time, as you listen to everyone’s stories and experiences and make the necessary changes, how does that not affect production going forward?

Jen Oneal: First off, there’s nothing more important to me than our people; and I know Mike Ybarra, who is partnering with me to lead Blizzard, feels exactly the same. Since I joined the studio at the beginning of the year, I’ve had the privilege of working closer with the Diablo and Overwatch teams. I’m seeing great progress on Overwatch 2, and the multiple games in the Diablo universe. I am constantly inspired by our talented teams, their creative vision, their commitment to putting gameplay first. Our people are passionate about our games. They understand our players, and in many cases they have come from the player communities themselves, and naturally are driven to serve them.

As Bobby and Daniel have mentioned, we are expanding these teams. We’re doubling down on our development recruiting as we expand the scope and vision of our franchises. When we come together, we make some of the best games in the industry, and we’re now seeing that energy applied to our culture, which is equally important. There is a lot of work ahead of us, but the passion and productivity are already here; and when our people feel safe and supported the rest is going to take care of itself.

Allen Adham: The passion that our developers have for innovation and creativity is what makes Blizzard great. It’s why we’ve been able to make so many great games for 30 years now; and this has always been the vision since the very beginning. I am excited about our future, about the things we’re creating together, about building a new culture and renewing that spirit. We’re tight lipped about it, but our new game pipeline has been in development for many years and is greater than it’s ever been across our core franchises and mobile, new IP and new genres. I’m looking forward to our teams launching their already announced new games in the not-too-distant future and in due course announcing a few new ones that you’ve yet to hear about.

Matthew Thornton (Truist Securities): When we think about Call of Duty, I guess, how are you feeling about this year’s release just in terms of the title itself across multiplayer as well as campaign, but also the cadence and breadth of content to follow? And then just finally, the competitive backdrop given that it’s a little bit of a busier year for kind of AAA releases in the genre, just want to get your thoughts there.

Rob Kostich: Before I get to it, I just do want to throw in some of the overarching comments, which I think are important as it relates to Activision Publishing as well. Obviously, there is no place for any harassment or discrimination whatsoever of any kind in society, in this industry, or in this company; and so, making sure we have a safe, and inclusive, and equitable environment for all of our employees is really the only way we can begin to live up to the values we aspire to, and it’s the only way we can become the company we aspire to be. So that is first and foremost on our minds and our focus at the moment.

Now, turning back to answer your question directly, we do feel really good about what Sledgehammer Games is leading for release in the fourth quarter of this year. The studio itself has never been bigger or stronger now with its teams in Foster City, in Melbourne, and also now in Toronto; and across all modes of play, across multiplayer, across campaign, and across co-op, development is coming along really well and we’re going to be sharing those details with the community very soon. Contentwise, it’s a really robust game at launch across all the modes; and the good news for us right now is we’ve gotten farther ahead on our Live Ops planning for supporting the community post-launch; and the community should also expect that support to be very, very significant. We’ve learned a lot over the last couple of years, and that’s all in our plans as we go forward.

We also have really exciting new plans in Warzone, which Raven is leading. Now together with our Premium release, we have some really fun, and what I consider the most significant update plan for the community across both Warzone and Premium as we head into the Fall.

Now, I do want to mention just a huge thanks to all of our amazing studios who have come together in an amazing way to drive the franchise for this year and for this fall and for beyond. They’re doing incredible work together as a team and also as independent studios; and finally, touching on your question on competition, I think competition is really out there each and every year for us, and I think we consider it a good thing for the industry and for our players; and to us, it’s not a zero sum game at all. We believe compelling new offerings have the potential to only grow the industry as we move forward. So our focus is really the same as it’s been each and every year, and that’s making sure we provide the most fun, the most incredible and the most innovative experiences we can to our community as we go forward; and when we look at the breadth, depth and quality of content, and our teams are delivering in Q4 across all our offering, we do like our position a lot.

Tyler Parker (KeyBanc Capital): So touching on King real quick, we saw 15% segment revenue growth and a doubling of the ad revenues in the quarter, so, clearly, still performing well here. I just would love to hear how the changes to Apple’s ecosystem affected visits in the recent month, both from a user acquisition perspective and an ad perspective? And I guess how you expect that trend going forward?

Daniel Alegre: I’ll take that on behalf of Humam. As you thought from our results, the IDFA changes really haven’t had much of an impact on our business and actually even less of an impact than we expected. But firstly, on the advertising side, we’re still early in building this business and we’re just seeing great results as we grow both the supply and the demand. On the supply side, we’ve been introducing innovative new products, and then started letting players watch more ads, if they wish to, growing our ad inventory in a way that’s really consistent with our focus and really not impacting the player experience and that’s worked out really well.

On the demand side, we’re working with more demand partners, and more categories of advertisers driving more volume and price competition; and this really has been very impactful. We’re also working hard to maximize the consent rates following the IDFA changes, and have seen much better than expected results there. So, as we said last quarter, we really still see a long runway for growth in ad.

Now, secondly in terms of user acquisition, again, if you look at the results, you can see the ongoing strength of the business. Most of our installs each quarter are organic, as we benefit from just the incredible awareness that our brands have globally, particularly a game like Candy, and our increasingly frequent live events are also just great vehicles for driving organic installs as well; and we have direct relationships with many of our most valuable players, and that allows us to reengage them if they last, and to really have a direct connection with them.

Now in terms of paid acquisition, we saw plenty of ways to bring players into the network, even following these changes on one particular platform; and the great growth we’re seeing in player investment really actually enables us to invest in even more ROI positive marketing while still delivering strong profits for each quarter. So again, more than comfortable in King’s ability to delivering sustained growth and in-game business, even after these changes; and the results, I think bear fruit to what I just said.

Kunaal Malde (Atlantic Equities): So it sounds like Call of Duty: Mobile has good momentum. Could you expand on your comment about its performance and the plans for further growth? And related to that, is there anything you can say on the recent China headlines and the potential for restrictions in that market?

Rob Kostich: I think I should probably break this up in two parts. Let me address the first part of your question on CoD: Mobile specifically; and then maybe I’ll invite Armin or someone else to chime in on a more macro view on China and any potential restrictions there. On mobile for us, we see three key opportunities kind of going forward; and I’d say those can be bucketed as geographic, operational, and strategic; and let me touch on each of those.

On the geographic front for Call of Duty: Mobile, we’ve seen obviously great success in the U.S. into Europe, and we’re also continuing to optimize across this region; but we’re seeing also great growth in emerging markets such as Latin America, India, and Southeast Asia; and we’re focusing execution and investment for local players; and so that’s something that they can still scale and help grow the business overall.

On the operational side, Call of Duty: Mobile is already a great game, and we see opportunity to make it even better. Our mobile team is continuing to do an incredible job of constantly improving the experience and adding content for players in the West; and the team just keeps getting better and better, which is a testament to their passion, and commitment to the mobile community; and China is just another example there where the title itself is off to a strong start, but still has a lot of opportunity in front of it to be tailored and optimized for the local audience, and the team is also very focused on that as well.

And then lastly is strategic. As we think about long-term, we always see more compelling growth on the platform; and overall today, we believe there’s an opportunity to better connect mobile to the overall Call of Duty ecosystem, and we’re aggressively hiring talent to help on this journey for us.

We’ve created our own internal mobile studio and are driving major recruiting effort across Beenox and Activision Shanghai, to support as well; and together, I think Daniel already mentioned on the call, these teams are leading an unannounced new mobile project in the Call of Duty franchise, which we’re very excited about. So, as I think about the business, as we start to approach the two year anniversary of the launch in the West, we think there’s a lot of both near-term and long-term opportunities on the platform for us, and to grow the audience and engage the audience on a broad basis.

Armin Zerza: With respect to your question on China, as you know, the rules and regulation in the country do change over time; and we have been working with our partners for many years now in this changing environment. So what we’re doing currently is working with them and our local team on the ground to assess this latest situation. Now, from a business perspective, China was less than 5% of our net bookings for last year, and as you know, we have a long history of adapting and responding to changes in the regulatory environment there; and of course, we need to continue to do so going forward.

Mario Lu (Barclays): So I just wanted to follow up on the question earlier on mobile advertising. A number of mobile gaming companies now have both a mobile gaming studio and an ad network all under the same umbrella. So curious to hear your thoughts of this strategy and if it’s something that King can potentially implement going forward?

Daniel Alegre: The good news is we’re actually already vertically integrated, and we have our own in-house ad business that supports in-game advertising across our mobile games, across all of Activision Blizzard and King. The Ads team has organically built our own advertising technology platform; and this is really made to enable both the demand and the supply management, which also leverages third-party technology, wherever it may make sense.

This approach has actually served us really well, and has enabled us to differentiate versus others in the industry through a much higher-quality player experience, both in terms of ad formats, then also how seamlessly ads are integrated into our games; and the other thing is just the opportunity to be involved in such a premium experience for the player has actually been very well received by our brand advertisers.

We have both advertisers and players who are benefiting from the experience; and I think that this goes beyond just King, as we launched more mobile experiences — as Allen talked about earlier, and across the company. We’re continuing to invest in our technology platform; and that’s just to make sure that we have the capabilities to power ad monetization and cross-promotional activities across our mobile titles.

So I feel we’re in a great position, having built these capabilities internally; and of course, longer-term, we have a great deal of optionality in terms of where we can take the platform; and that’s why we continue to invest in this area, which is critical to our business.

Armin Zerza: Thanks all again for joining us today, and your interest and participation. We look all forward to catching up with you in the coming weeks. Thanks.

Hope you enjoyed this article. Please, support Blizzplanet via PayPal or Patreon, and follow us on Twitter, Facebook, YouTube, and Twitch for daily Blizzard games news updates. |

|